We’re a few weeks away from closing the book on 2022. Wow, what a rollercoaster year for the financial markets. New participants received a valuable education on how inflationary forces can alter asset relationships. Growth equity investors severely underperformed, as higher rates proved to be too much for high growth, non-profitable companies. Market sentiment reached historical lows, as pessimism tied to the future prospects of the global economy plagued investors. Russia-Ukraine, PMIs crashing, yield curve inversion, FTX collapse…the list goes on. There’s been no shortage of reasons to grow skeptical of the markets - but all is not lost. Cycles need time to play out. In this environment, like every other, quality security selection and proper risk management is priority one.

It was suggested to me, that I take time in December to reflect on the year. What thesis did you abandon in 2022? What did you stick with? What’s changed since January? I’ve asked myself a lot of questions but none more important than, “What did you learn this year?”

The short answer is, quite a lot. But I’ll keep it to 3 things for the sake of your Sunday afternoon. Let’s get started.

1) Regime Changes Can Happen Fast!

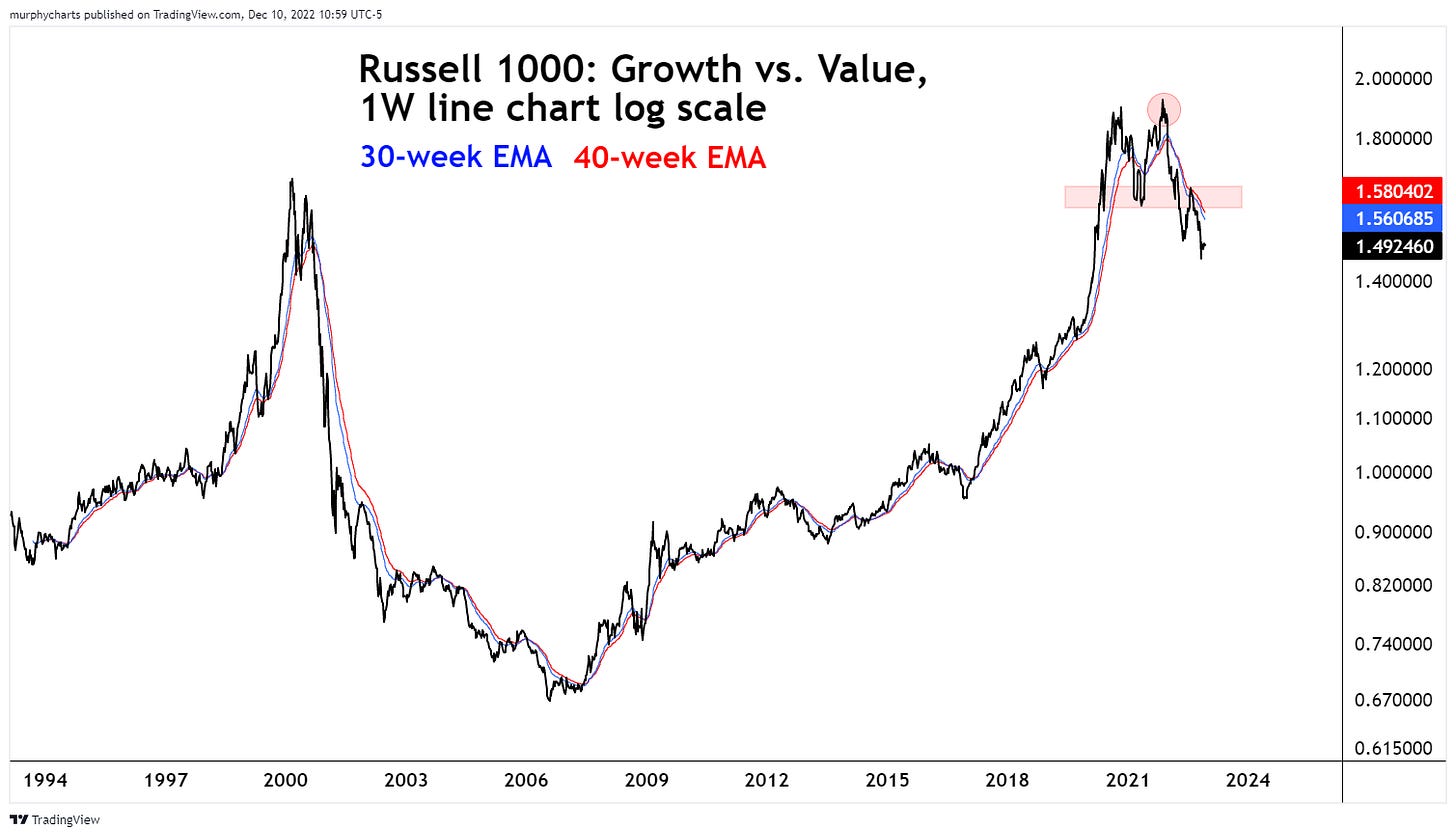

Regime shifts can play out gradually at first, then all at once! Just take a look at the below chart of Russell 1000 Index: Growth vs. Value. The ratio formed a new weekly closing high in November 2021, but the subsequent 12-months saw consistent outperformance from Value. In the first week of January, the ratio made a sharp move lower beneath the 30 & 40-week moving average. It’s remained in a persistent downtrend in favor of Value ever since.

2) Don’t Fall in Love with an Asset Class

A tale of two halves. 1H 2022 saw significant outperformance of commodities over stocks. 2H saw the exact opposite. The 6M performance spread of SPX:SPGSCI as of today = +21.74% in favor of stocks. A great reminder to not fall in love with an asset class. Commodities formed new lows this week and if history is any indicator, they are typically the last to form a cycle bottom. Commodities did prove to be a strong diversifier this year. They played their role and earned a roster spot. The S&P Goldman Sachs Commodity Index is +17.8% on a YTD basis.

3) Beware or Be Aware of Home Country Bias

The below chart outlines the year-to-date performance spread of US equities vs. Non-US Equities (adjusted for dividends). Despite the monster run up in the US Dollar in 2022, Non-US equities (denominated in USD) are outperforming US equities on a year-to-date basis. I can’t understate this enough. Diversifying outside the US is as important to your portfolio as rebalancing or index/manager selection. Determining the optimal target weight of Non-US stocks is a different conversation, but it doesn’t take away from the fact that their presence in the portfolio is very important. Just take a look at the composition of various country indices. The US looks vastly different from Europe, Europe is different than Japan, so on and so forth. The source of return also varies. The indicated dividend yield on the S&P 500 is roughly 1.50%, on the MSCI ACWI Ex-US Index, the indicated dividend yield is nearly 3.75%. Two very different markets!

In the words of Leonardo da Vinci (who I hear was a fan of the Fibonacci sequence), “Learning never exhausts the mind.” If you find yourself operating within the financial markets, you will continue to learn, year after year in perpetuity. There is no book or knowledge source that can relinquish our need for continued learning. Markets evolve, relationships change, and if we as participants choose to ignore this, we will surely be dissatisfied with our results.

That’s enough out of me. I hope everyone enjoys the holiday season - best of luck as we head into 2023!

SM

Great stuff. Thanks and Happy Holidays!

Some important highlights of what we learned from the financial markets in 2022.