Triple Tax Advantaged Health Savings Account: What Does This Mean & Why Should I Care?

You’ve been working with a wealth manager for a few years now. Your savings are built up to a level that makes both mathematical and behavioral sense to you e.g. 3-12 months of expenses built up, targeted savings bucket for big life purchases, special expenses etc. You’ve received guidance and developed a game plan to pay down outstanding debt such as student loans. Things feel good. You’ve made real progress and are now exploring ways to maximize your retirement savings.

You are maxing out pretax contributions into the ol’ employer retirement plan (401k, 403b etc.). In doing this, you are putting retirement money away, receiving your employer match AND reducing your taxable income in the process. You may have a Roth 401k option available to you, but for the sake of this post, let’s say you don’t. You’ve reviewed the ins and outs of a Roth IRA, understand the income limits and are putting after tax dollars to work for your retirement.

Emergency Fund and Targeted Savings (check)

Debt Payment Game plan (check)

Employer Retirement Plan (check)

Roth IRA (check)

So what’s next?

Do you open a non-retirement brokerage account and begin investing there as well? Maybe. But before deciding, I believe it’s worth exploring a health savings account (HSA).

HSAs are a relatively new account type. They were established by Congress in 2003 and offer very powerful advantages to savers.

Contributions to HSAs are tax-deductible (just like your pre-tax 401k contributions). When it comes time to take withdrawals, the investment gains AND the withdrawal itself are tax-free, so long as the funds are used to pay for qualified medical expenses. Hence the Triple Tax Advantage.

Sounds pretty good, right? Well it gets better. After age 65, you are eligible to withdraw funds for ANY expense, not just qualified medical expenses. The one caveat being the withdrawal is subject to income tax. After age 65, if you withdrawal for a non-medical related expense, the withdrawal will be treated just like an IRA distribution i.e. the gains are tax free but the withdrawal itself will be viewed as income for that year and tax will be owed.

Unlike IRAs which have income limits, HSAs carry none. However, to be eligible to contribute to the HSA you must have a high-deductible health insurance plan (HDHP). Not all HDHPs are HSA eligible, so it’s super important you check with your employer or health insurance company before contributing.

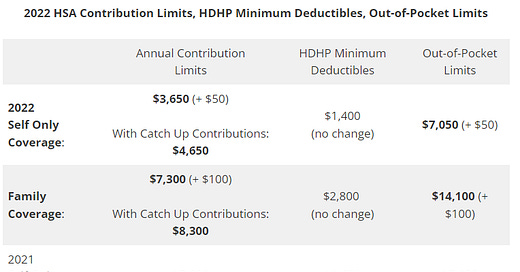

Below is a table breaking down the contribution limits, minimum deductibles and out of pocket limits for 2022.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Please contact your financial professional for more information specific to your situation.