For many retirees, their investment portfolio consists of a mix between stocks and bonds.

In a deflationary environment, the two asset classes are inversely correlated.

i.e. bonds up, stocks down.

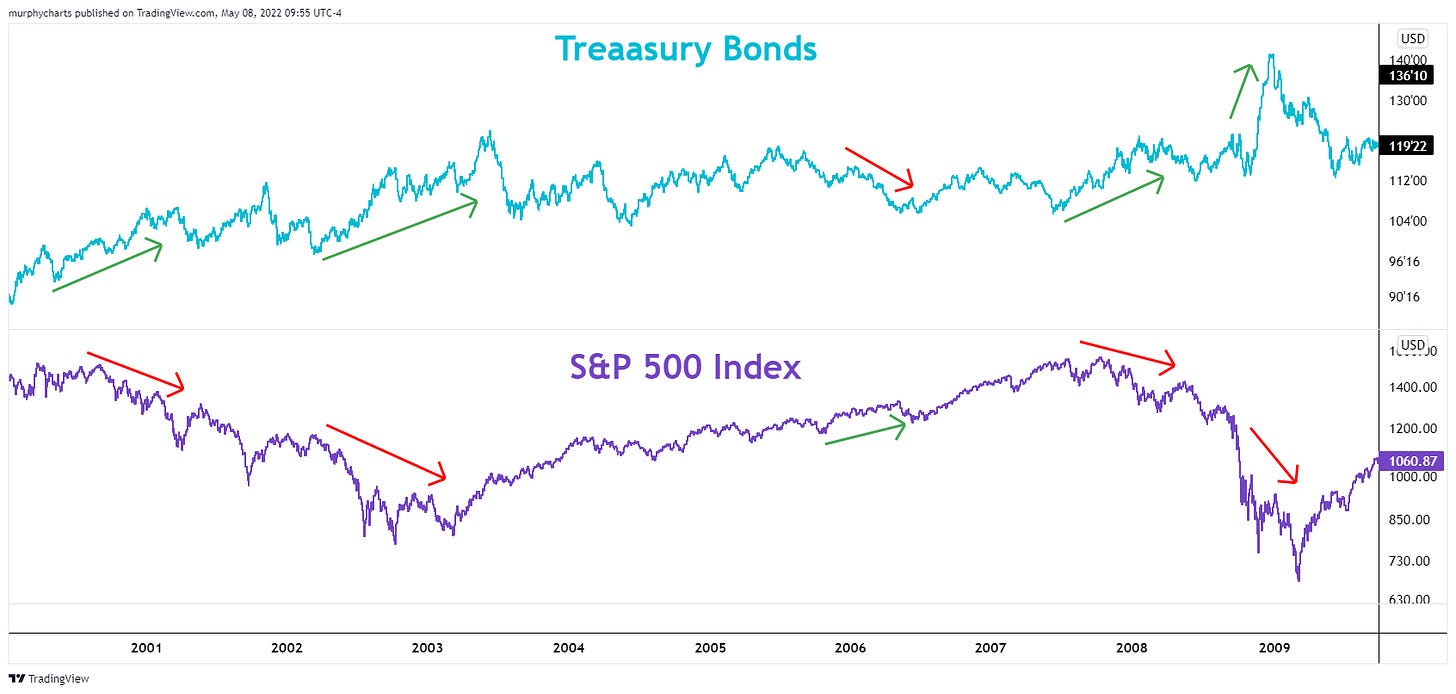

The below chart highlights certain deflationary events that sparked a decoupling between stocks and bonds i.e. dot com bubble burst, 2006 housing bubble burst, and the 2007-2008 Financial Crisis.

Deflationary event or recession occurs:

stocks decline

interest rates decline

bonds advance

It is for this reason, that diversification is so important. Bonds are viewed as providing “downside protection” during times when deflationary threats warn or lead to recession.

But what about during inflationary times?

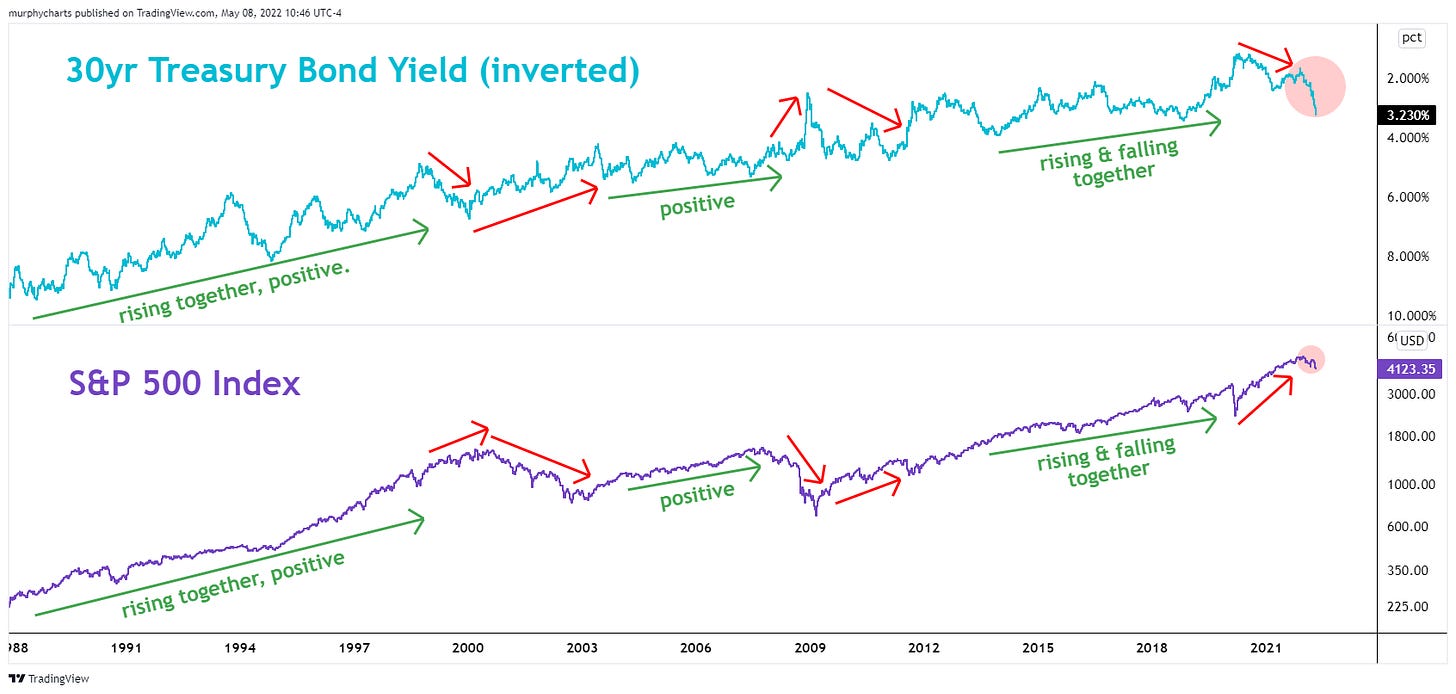

In an inflationary environment, the two asset classes are positively correlated.

i.e. stocks up, bonds up

With bonds up, interest rates are declining. Low rates stimulate the US economy. Fundamental drivers of price trend (corporate earnings) improve and stock prices advance to the upside.

With bonds down, interest rates are advancing. High rates dampen demand and cool the US Economy, this can negatively impact stock prices.

The below is a long-term view of the various environments where stocks and bonds are positively correlated. It is important to note, an inflationary environment does not equate to strong inflation prints per se. More so, inflationary forces are trumping deflationary forces. full stop.

In 2022, it is without question, the environment is inflationary. Stocks and bonds are positively correlated, moving in tandem to the downside. The S&P 500 Index is -13.4% year-to-date, while the Barclays US Aggregate Bond Index is -10.4%.

For an investor with a 60/40 portfolio of stocks and bonds, it’s been a difficult year. Bonds are not providing any relief, outflows continue despite yields becoming more attractive than 12 or 18 months ago.

There are areas investors are hiding out to capture alpha i.e. commodities, US dollar/cash, utilities and energy related stocks. If you lacked exposure to these areas, it’s been a frustrating year thus far.

Bonds tend to lead the stock market, it would be a bullish datapoint for long-term equity investors if we see bonds begin to bottom and resume their nearly 40-year primary uptrend. The question is, what will it take to see that happen and how long will this new interest rate cycle last?

That’s enough out of me.

SM

Nice summary and important reminder of the facts🍀