Push & Pull

The battle between earnings and bond yields continues.

US stocks have gone nowhere since June of 2022. The market remains range-bound, hovering between 19x - 17x forward earnings ($215 per share estimate). So what gives? What will it take to pull this market out of its sideways consolidation? Many are hyper-focused on earnings, with 40+ companies with >$100 billion market cap reporting next week. Earnings drive stock market returns, there’s no question about that. However, it’s important to remember that forward earnings don’t tell us much about what to expect of short-term future returns.

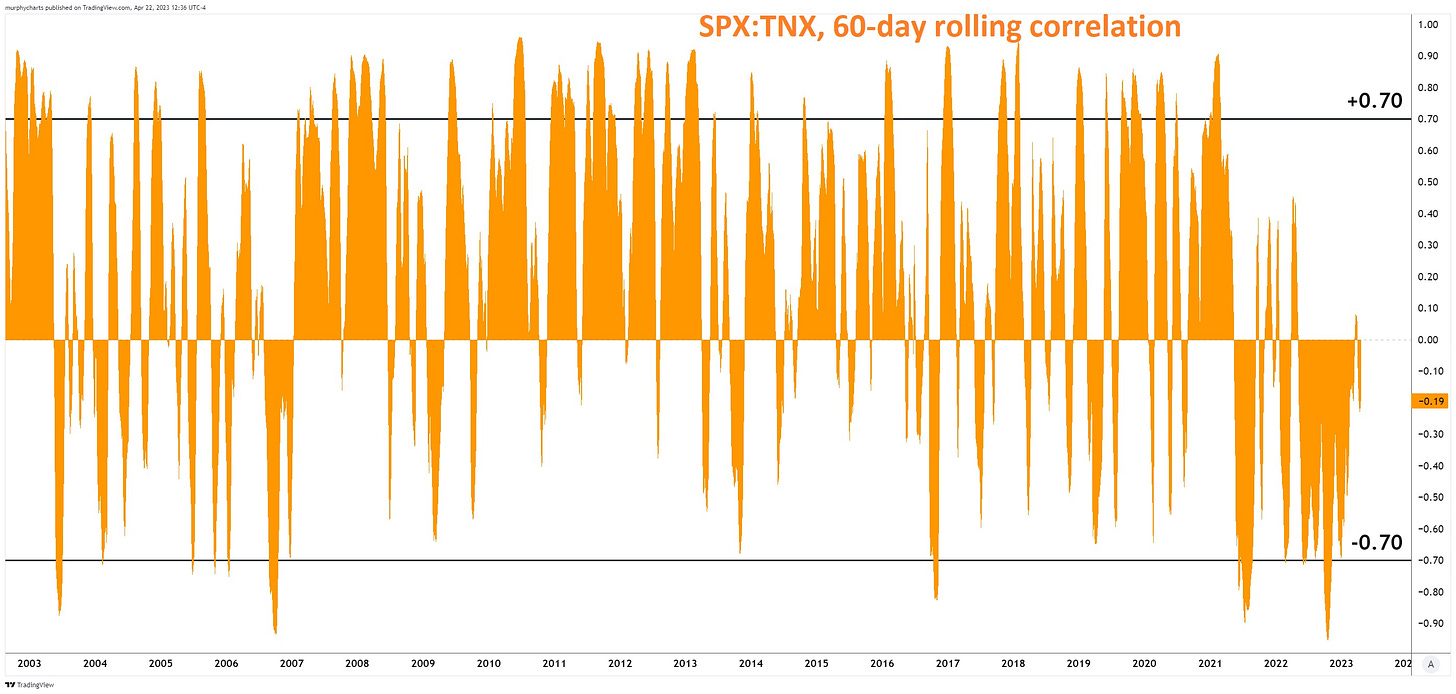

So far in 2023, bond yields are playing a big role in the resilience of the US stock market. With negative earnings growth in 2023, a decline in bond yields could be enough to offset the earnings decline and allow stocks to resume their primary uptrend. Stocks and yields are in the most negatively correlated regime in over 20 years. (Thank you inflation!)

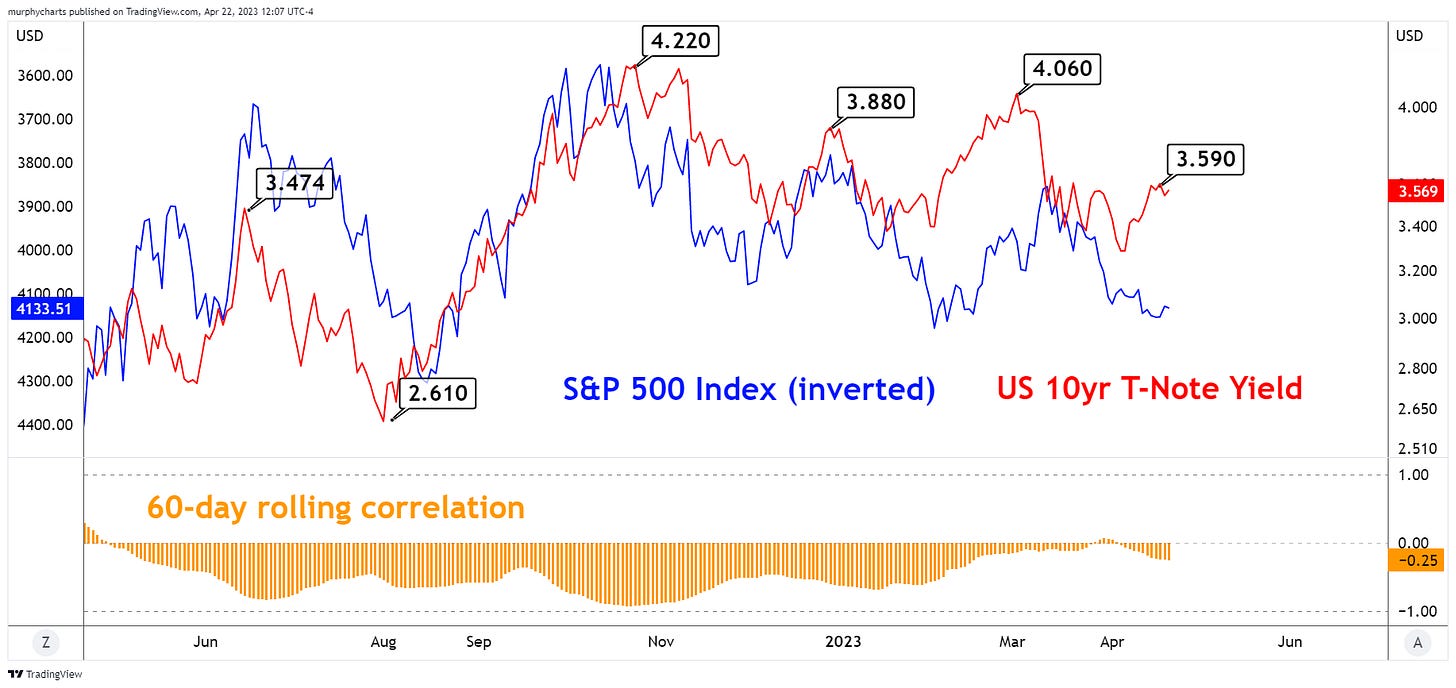

The below chart displays a 1-year period of US 10yr T-Note Yield overlayed with the S&P 500 Index set on an inverted scale. Since the market all-time high in January 2022, a decline (rise) in yields has corresponded with a rally (fall) in stocks.

The below chart displays the historical 1-year value change in bond yields overlayed with the forward 1-year percentage change in US stocks. Following a period of rising (falling) yields, 1-year forward stock returns are muted (amplified).

Liberum Capital’s Joachim Klement sent out a post in February speaking to the tug of war between earnings & yields. Below is an excerpt from his post.

“The earnings decline in a recession is large, but in effect, it only impacts the projected cash flows over the coming 12 to 24 months. Meanwhile, the change in bond yields (and hence discount rates) may be small, but this change impacts every cash flow from today to eternity. And because typically, more than 80% of the fair value of a company is derived from the net present value of cash flows more than five years in the future, a change in bond yields has an outsized influence on the share price compared to a change in earnings.”

Some are looking out at 2024 earnings, where estimates remain elevated, although declining in recent weeks ($245 EPS estimate). In my opinion, attempting to predict future earnings and subsequently make investment decisions based on the forecast, is not a robust strategy. You’ll ask yourself, “What multiple will participants be willing to pay for these future earnings?” I’d rather let price and trend tell us what participants are willing to pay! Markets can stay overvalued/undervalued for a lot longer than we’d expect. In my opinion, the current environment has highlighted the value of implementing top down and intermarket analysis. Earnings estimates are great - but they aren’t the only guiding light. The brightest part of my approach is and always will be price!

Well written 🍀