Price of Admission

Volatility is uncomfortable. No one enjoys seeing their portfolio decline in value. However, volatility is the price of admission to the stock market. It is what allows us to achieve an annualized return of 12% since 1980. It is what allows your retirement assets to grow and combat the villain that is inflation. Volatility is what we sign up for when we invest in any risk-asset.

When in doubt, zoom out.

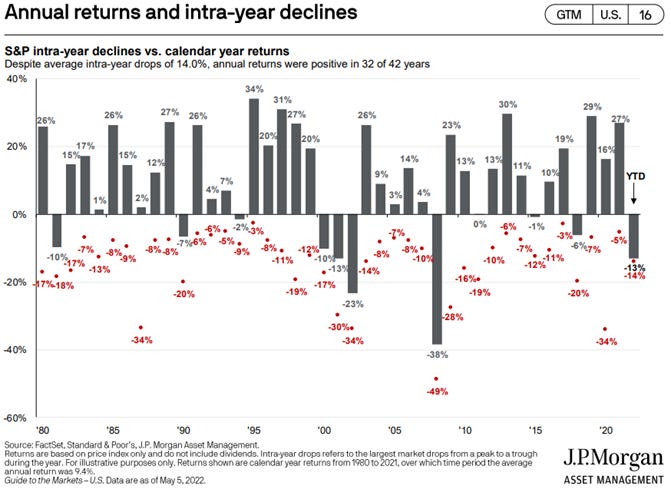

As human beings, it is very easy to anchor our minds to short timeframes. Whether it be year-to-date returns or 1-week returns. These timeframes may tell a story about the current state of the market, but we mustn’t lose the forest for the trees! The below chart depicts annual returns for the S&P 500 Index from 1980-2022. Of the last 42 years, the average intra-year decline is 14%. That’s right, the average intra-year decline, peak to trough, for the S&P 500 since 1980 is 14%. Of those 42 years, 32 of them saw the S&P 500 Index finish the year with a positive return. That’s quite a heavy data-point. As of May 10th, 2022 the S&P 500 Index is -16.2% year-to-date. Seems about right, this is in line with what we should expect any given year from the US equity market.

Being aware of behavioral biases can make us better investors.

Loss aversion is an emotional bias that many investors fall victim to. It is the tendency to prioritize avoiding losses over earning gains. The bias explains why investors are more sensitive to losses than to comparable gains. It is said within behavioral economics, the pain associated with loss is twice as powerful as the pleasure received from gain. Investors who fall victim to this bias may end up with an overly conservative portfolio that does not achieve adequate return for their desired goals. The bias can also lead investors to selling positions during market downturns, which could result in missing out on gains during a market rebound. We can better position ourselves for long-term success by becoming aware of these biases and discussing them with a financial professional.

Time IN the market, not timing the market.

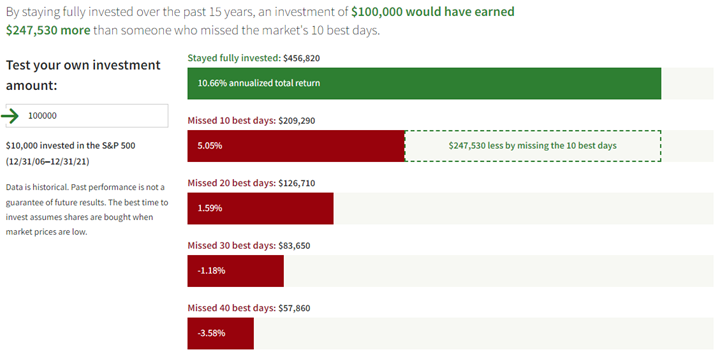

Below is a graphic displaying the return on $100,000 invested in the S&P 500 Index from 12/31/06 to 12/31/21. If you missed just 10 of the best days during that period, your investment return is reduced by more than ½. When it comes to achieving superior returns, staying invested is a part of the solution!

I began this post by stating that volatility is uncomfortable. There’s no question about it. Our job as money managers is to better equip our clients to get through volatile periods. We do this by evaluating your tolerance for risk and designing portfolios that shield you from market volatility. Part of our solution is becoming aware of the biases that impact our decision-making and staying true to time-tested, disciplined investing approaches.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Please contact your financial professional for more information specific to your situation.