Market Thoughts

We’re a few weeks into Q2 and there remains an insatiable risk appetite for US equities. The below chart outlines the S&P 500 and the percentage of stocks above their 200-day moving average. Moving averages help us not only identify trend direction, but the strength of trend as well. If a specific stock index is printing new 52-week highs, but the percentage of stocks above their respective 50 or 200-day moving average is declining – this would constitute a bearish divergence. It is signaling that although the index is forming new highs, not all of its constituents are necessarily participating in the move higher. During the recent rally in the S&P 500, the percentage of stocks that were trading above their 200-day moving average reached its highest level in over 15 years. That’s one strong move!

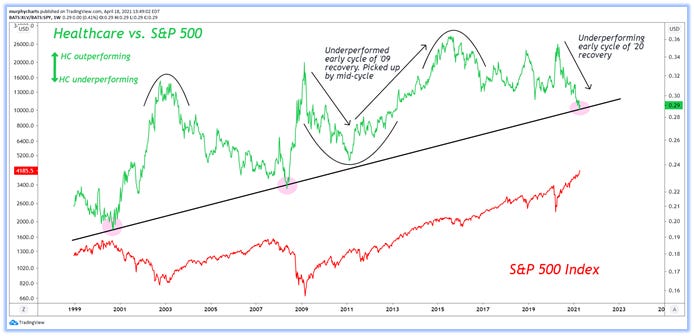

With benchmark stock indices breaking out to new all-time highs, the defensive and less “flashy” sectors, specifically healthcare and consumer staples are not receiving much love. However, now more than ever they deserve our attention. Not because I believe these areas of the market will outperform in 2021 and not because they offer the most attractive growth prospects for long-term investors - but because we find ourselves in the 10th year (give or take) of a secular bull market and these sectors offer attractive relative valuations.

To couple the attractive implied upside of these sectors, their relative strength charts are piquing my interest. Just take a look for yourself! Coming into the GFC recovery, healthcare underperformed, but by mid-late cycle it began to really pick up steam relative to the broad market. Industries within healthcare, primarily pharmaceuticals and providers may be worth taking a closer look.

Another interesting chart is the Consumer Staples sector relative to the broad market, overlayed with the ISM Manufacturing PMI on an inverted scale. ISM PMI is a great gauge for the manufacturing strength/trend of the US economy. It is very correlated to the year over year performance of the S&P 500 index. With blowout numbers coming from ISM PMI, it makes one wonder if now is the opportune time to hedge your portfolio with some lower beta consumer staples names.

These two sectors aren’t as flashy as technology or discretionary, but they are quality US large-cap companies and many of them have an above average dividend yield. These types of investments aren’t for everyone, but they’re worth mentioning! Flows are flooding into stocks, the VIX is dropping, sentiment is neutral for the most part - you can easily argue these areas aren’t a great fit in the current risk-on environment - I wouldn’t disagree with you. But when less attention is placed on any one factor, sector or theme my natural response is, “let’s take a closer look.”

That’s enough out of me.

SM

awesome summary of the market