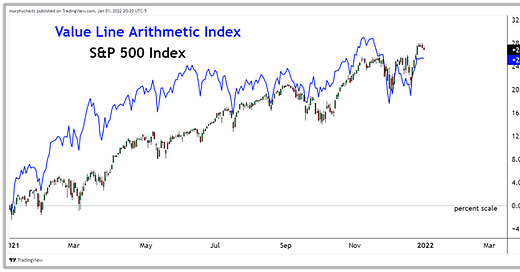

2021 highlighted the momentum-like nature of market cap weighted indices. Despite all the chop we saw from the average stock in the US, an index like the S&P 500 was able to stay above its 50-day moving average 91% of the time. Talk about strength of trend! 2021 was a very difficult year for investors seeking passive exposure to global ex. US equities. It’s easy to point to the monster returns achieved from the major US stock market averages, but around the globe other markets struggled to keep pace. In a passive world, it can feel as if market capitalization is all that matters. Majority of indices are constructed in a way that benefit from a type of momentum due to market cap weighting i.e., A company appreciates in value, simultaneously increasing its market cap, resulting in a larger index weighting and increased influence on the direction of said index. But what happens when the largest weighted components fail to keep up or just downright decline?

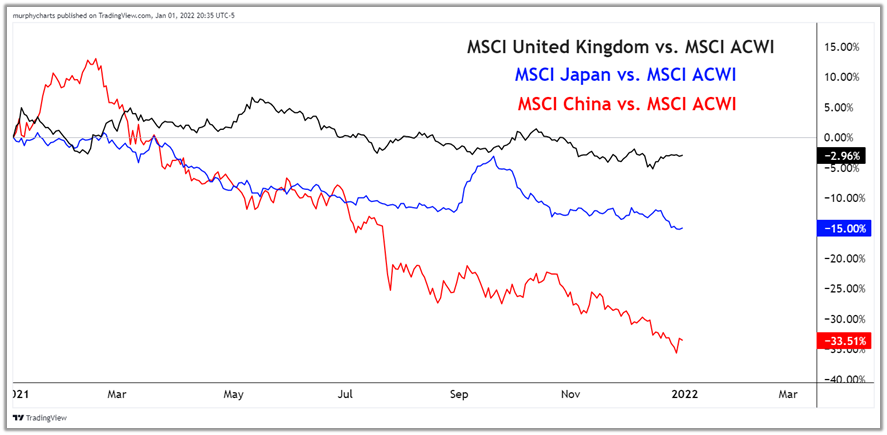

Passive global ex. US indices failed to achieve double digit returns in a year the S&P 500 returned +28.8% and the MSCI ACWI returned +19.3%. Due to market cap weighting, majority of these global ex. US indices carry their largest country exposure within Japan, China, and the UK. Even with UK equities returning +16.6% in 2021, an index such as the MSCI ACWI Ex. US displayed a relatively modest return of +7.1%. This underperformance can be attributed to Japan and China failing to participate in 2021’s global equity bull market. MSCI Japan and MSCI China index returned +2.4% and -22% respectively. Below is a 1-year percent scale chart of all three MSCI indices relative to the MSCI ACWI Index.

In terms of global market cap, the US accounts for nearly 60% of the world’s equity market cap. It can be said that a portfolio with greater than 60% allocated to the asset class is “technically” overweight. Wealth managers seeking increased exposure to developed Europe, Asia and emerging markets, saw a significant drag in performance this year. Especially if they sought passive index exposure. 2021 marked one of the widest performance differentials between the S&P 500 and the MSCI ACWI Ex. US over the last decade.

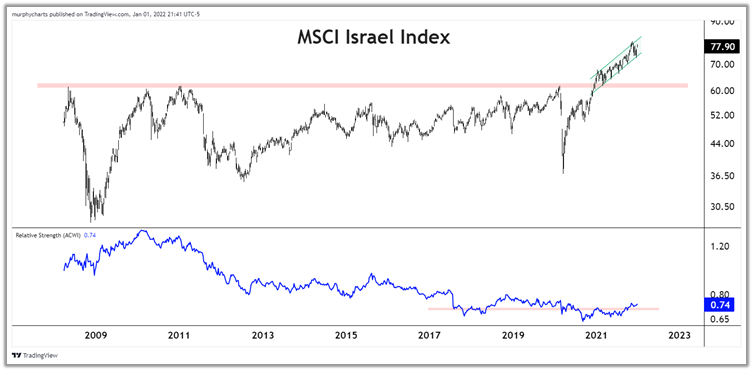

So what’s the deal? Do we remain “over-allocated” to the US or is there opportunity knocking in other parts of the world? The point of this post is not to provide a recommendation – rather, to point out that despite global ex. US indices underperforming the US so dramatically, there are foreign stock indices in healthy uptrends, performing quite well on both an absolute and relative basis. Below are a handful of country specific indices I’ll be keeping an eye on in 2022.

MSCI Taiwan Index

Nifty 500 Index (India)

MSCI Denmark Index

CAC-40 Index (France)

MSCI Saudi Arabia Index

MSCI Netherlands Index

MSCI Canada Index

MSCI Israel Index

It is not as if we’ll be trading any of these indices directly – but the evidence is there, the US is not the only region of the world that achieved superior returns in 2021. Passive global ex. US investments severely underperformed both the S&P 500 and the MSCI ACWI Index. 2021 is a great example of the shortfalls of passive management as it relates to the international equity sleeve of your portfolio. With 2/3 of the largest country exposures failing to participate in this year’s bull market, the MSCI ACWI Ex. US index never stood a chance.

What’s the solution?

I believe active management within the asset class is worth exploring. Whether that means independent security selection or hiring of a mutual fund manager, there is a need for active management in the international equity space. A review of strategies outside passive indexing is worth our time and attention.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Please contact your financial professional for more information specific to your situation.

Great article and insight